Blogs

If the credit score is just too low in acquisition getting acknowledged to the Amex Bluish Dollars Popular card, in that case your first attention is going to be for the boosting your credit score first. Whatsoever, it makes no differences how high away from a plus give you see for those who’re also incapable of get approved on the cards. You might transform between which credit as well as the no annual commission Bluish Dollars Relaxed AMEX. Which credit won’t contend with the new Citi Double Bucks Cards, and therefore produces dos% money back every-where to possess standard requests. It cards typically features an excellent $95 annual percentage as opposed to a good waiver for the first 12 months, but with so it offer will get a good $0 introductory annual fee on the first year.

Is Family savings Incentives Worth it?

- An ample signal-up extra can also be boost your own benefits travel to make your brand-new cards become much more rewarding.

- When it comes to import day, Come across Bank probably has got the quickest cleaning go out, however, we’re these are a difference out of 2-three days vs 4-five days during the most other of those.

- Away from industry experts in order to analysis analysts and you may, naturally, mastercard pages, we’re also well-positioned to deliver the best way forward and up-to-go out details about the credit card universe.

- You’ll secure 2X points for the Southwest purchases, regional transportation and you can driving, in addition to rideshare, and on internet sites, cord, and you may cell phone characteristics and pick online streaming, and step one area for each $1 used on other purchases.

- For the Investment One to Spark Kilometers to own Team credit, small business owners that simply don’t need to love added bonus categories can be earn quick take a trip rewards, obtaining the equivalent amount of miles for each purchase.

Users just who make an application for a great DBS yuu Card from one February in order to 31 July 2025 (having recognition by 14 August 2025) can get S$3 hundred cashback when they purchase at the very least S$800 inside very first 60 days of recognition. Pursue has a “Shell out Oneself Back” program one allows you to make use of your perks for report credit on the requests out of find categories for a price of 1.25% for each area. To prepare such section transfers, attempt to phone call the customer service amount on the straight back of your own Pursue cards and also have a representative hook her or him utilizing the credit number of each other. Up coming, you should visit your home member’s account in your on line account among the import choices. Zero, you will have to submit an application for the brand new Pursue Sapphire Well-known to your its very own to earn so it acceptance extra. Luckily one holding a great Chase Liberty credit would be to not prevent you against becoming eligible for it offer.

Digital Purse from PNC Financial

The capital You to Strategy X Team credit is a superb all the-up to superior perks card that assists your tray up miles on the all company expenses. The capital You to Venture X Benefits Mastercard ‘s the advanced Money One to take a trip advantages card on the block. In terms of notes that offer finest-level professionals, you’d become hard-pressed to find a better card available to choose from than the Rare metal Card from Western Share. Offering a collection of over 20 cards, Jarrod could have been a professional from the points and you can kilometers room for more than 8 decades. He earns and you may redeems more 1 million items per year, and his awesome work has been searched in the shops including the The newest York Times.

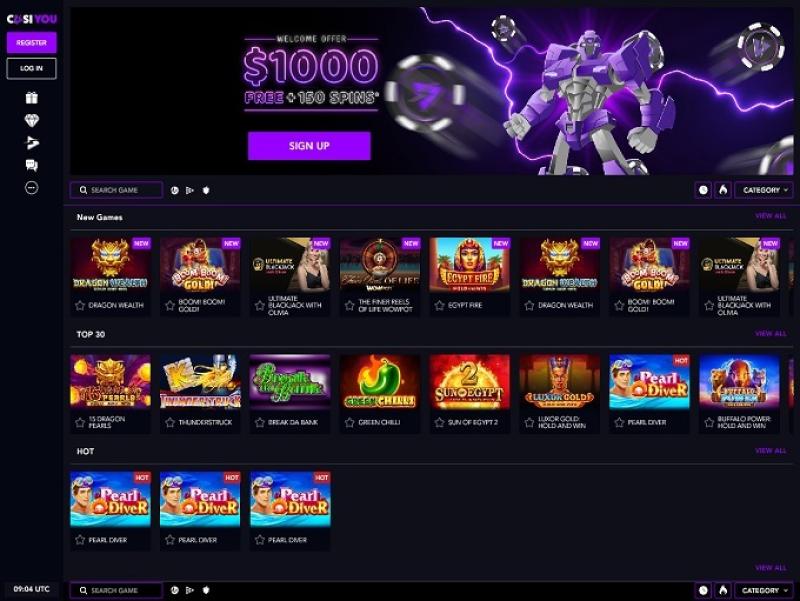

Exactly how we Price United states of america Casinos on the internet That have $300 No deposit Bonus Codes

In addition to zero month-to-month account charge, Largest Savings have an ample online transfer restriction away from $100,one hundred thousand back and forth from other banking institutions. Dumps take place during the Mix River Bank, Associate FDIC, and so are covered around $250,000. Modify are a monetary technology team that provides a checking account called Biggest Discounts, which earns a competitive 4.02% APY to the balance out of $step one,one hundred thousand or more. Keep this rates not in the first 90 days by the welcoming a great friend or family members to open up a good Marcus savings account with your recommendation hook up. For those who have lower than $5,100000 and would like to follow CIT Bank, then i indicate their Savings Hook up account instead that provides an easy cuatro.00% APY to your all of the balance numbers. Because the deposit standards are very higher, the fresh membership’s rate of interest away from cuatro.10% to own balance out of $5,one hundred thousand and higher might possibly be a compelling reason in order to sock aside including a big contribution.

Find has recently welcome people to make use of just one sign-on the to possess playing cards and you will banking, streamlining men’s capability to create their cash. This really is a net confident because it eliminates need to track other usernames and you will passwords. The following financial things didn’t somewhat enable it to be on the greatest five checklist, nevertheless they are entitled to becoming stated due to an invaluable ability, work for, otherwise brighten you to definitely isn’t well-known for discounts membership. You can unlock a savings account which have only $1 there are not any month-to-month membership service costs to be concerned on the. You can earn so it added bonus that have 1 of 2 checking account during the financial — a consistent family savings otherwise one that doesn’t enable it to be overdrafts.

Sure, you’ll find greatest of those available however it is https://mrbetlogin.com/brilliants-hot/ simply simple to utilize and keep maintaining the new Apple Cards. Rating a great $300 incentive after you open an american Show High-Give Bank account, put qualifying financing, and keep maintaining the balance to own 60 days. Here is the highest bonus provide Amex has ever before delivered to their checking account. To attract new customers, of a lot banking institutions tend to offer a sign-upwards extra once you open another membership. To have examining membership particularly, such incentives will be no less than $a hundred.

- Buying inside lists is dependent on marketer compensation, as well as searched placements at the top of a given checklist, however, our very own device information will never be influenced by entrepreneurs.

- All of the details about low-associate also provides for the Bluish Bucks Preferred Credit away from American Express try collected separately by cardsandpoints.com.

- If not satisfy some of the conditions to make step three.80% APY2, the APY was proper step 1.00% APY on the discounts balance, that’s however higher than prices supplied by of many antique financial institutions.

- You might like to try to secure so it extra having one away from three additional accounts.

Open an alternative BMO Wise Virtue Bank account with a marketing code you’ll discover away from BMO once you implement. You might discover an account on the internet, over the phone otherwise by going to a local branch. Sign up for direct put, and you can discovered at the very least $4,100 in the qualifying deposits within 3 months away from account beginning. As the Wells Fargo extra offer try tempting, know that Wells Fargo does charge a great $10 month-to-month service percentage.

For a bonus, you’ll constantly must either see at least deposit demands or discover qualifying head deposits. With its comprehensive list of greatest-notch travel advantages, a rewards rates and you will big welcome provide and you can referral incentive, it’s easy to see as to why the newest Pursue Sapphire Common is at the top its group. Jessica Merritt try an experienced personal fund creator focusing on borrowing notes, individual financial, and you can financial fitness. Which have 8 many years of experience viewing bank card now offers, perks software, and cash-preserving procedures, she assists clients build informed financial behavior.

Try to get to the acceptance bonus because of normal spending to bolster your money as opposed to removing from their website. Thankfully, there are no monthly fees to bother with there’s zero very early membership cancellation fees sometimes. The school Student Savings account is made for pupils old 17 to help you twenty-four signed up for college otherwise a great vocational, technical otherwise trade university. The fresh fee every month is waived until you graduate, but a fee every month out of $twelve tend to use just after graduation.

That it provide ends Could possibly get 12, just in case you’ve been on the fence in the an alternative traveling bank card, which possibility really should not be overlooked. It may be a drag to start an alternative bank account aided by the functions you need to do to update lead put and put right up all your autopayments. However, a little more about financial institutions enable it to be well worth it by the giving new clients a plus after they unlock a merchant account and meet what’s needed. While you are usually we have viewed that it membership render a somewhat all the way down added bonus without lowest direct deposit specifications, which $three hundred offer continues to be relatively accessible.

The fresh checking & deals people can also be earn up to $five hundred

While this doesn’t be sure recognition, the probability of taking acknowledged enhances notably than the a person who is applicable to have a credit making use of their website. You’re eligible for a funds incentive after you complete expected points – just click here for information. Earn $fifty bonus borrowing of Santander Bank after you refer a buddy to open a different Checking account and you may complete the standards. Santander Lender is offering a promotion of up to a good $step one,one hundred thousand incentive after you open a new Santander Financing Features IRA and you may qualify lower than.

Betting Requirements

If you’d like traveling, you may also make use of this credit to another country for the care and attention of foreign exchange charge. You’ll be able to earn a massive 4X points for the the Traveling groups if you are an excellent PenFed Remembers Advantage Member, or even it’s 3x points. Getting a good PenFed Remembers Virtue Member is simple – just have and sustain a good PenFed checking account Or have armed forces solution. For individuals who don’t have to deal with a steep yearly payment, the new Western Share Bluish Cash Relaxed Cards is an excellent beginner credit for perks for the food, fuel, and you may retail requests.